With a growing interest in sustainable energy options, companies across many industries, including power companies, are looking for ways to make money and improve the environment. Trading renewable energy certificates is one way they could achieve these outcomes. Learning about these documents and the processes around them can help determine if the company you work for might be eligible for this option. In this article, we answer ‘What are renewable energy certificates?’, discuss how they work and review the answers to the most frequently asked questions.

What are renewable energy certificates ?

To answer the question ‘What are renewable energy certificates?’, a renewable energy certificate (REC) is a marketing commodity you can sell representing both the energy you generate and sell along with the positive attributes of that energy. You receive an REC when you generate one megawatt per hour of a renewable energy source, such as solar or wind power.

Some common alternative names for RECs include:

- green tags

- tradable renewable certificates

- renewable electricity certificates

- renewable energy credits

Each of these might vary in value or conditions, though they commonly provide similar tracking and accounting for these types of energy sources.

How do RECs work?

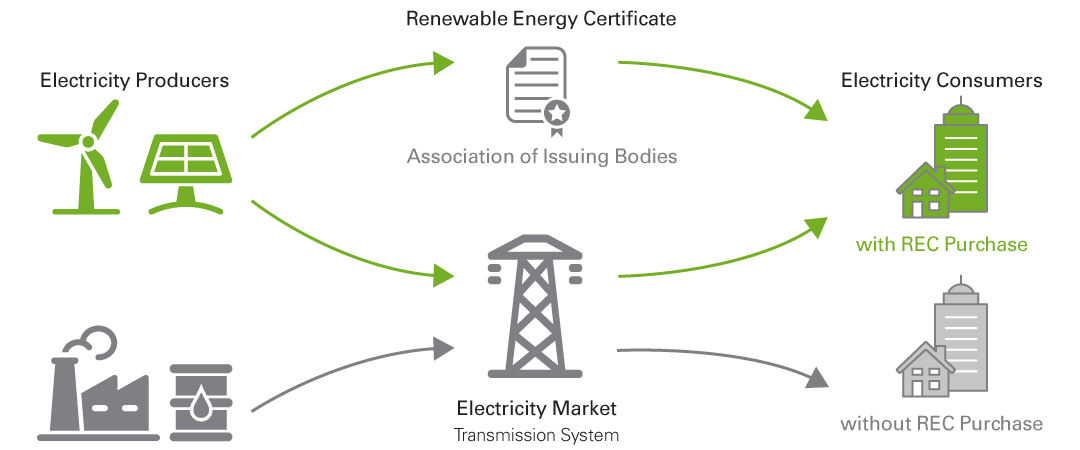

RECs work as documents allowing the tracking of renewable energy entering a power grid. This usually involves solar or wind energy providing electricity for a specific location. From there, the provider of this type of energy receives a credit it can sell in open marketplaces. Though the standard of one megawatt per hour remains the same for all RECs, the prices vary depending on how much demand there is and how electricity companies meet their renewable energy goals.

Energy companies can also sell RECs to speculators in the market. These people often review different market options and futures and might purchase RECs if they expect their value to increase over time to make a profit.

Renewable energy certificate requirements

The specific requirements to receive an REC are:

- Power utilities: To earn credit, an individual could have power utilities that help generate electricity for a grid. Examples of this include solar panels, geothermal generators and hydrogen fuel cells.

- Renewable portfolio standard: Many governments require that the location has a certain amount of renewable energy powering sites. This means that power companies can use RECs from individuals or other businesses to meet the standards.

- Broker: For some uses, corporations require a broker to oversee the trading and energy use. They might recommend places where RECs are more affordable based on supply and demand or ensure energy companies can meet their required standards.

Renewable energy certificate example

Here’s an example of how a company could use renewable energy certificates:

Stationery Manufacturing Inc. is a leading global provider of office and school supplies. At their primary production location, they continuously manufacture their own goods and ship them to various countries. As the production requires a lot of electricity, the company buys several RECs to ensure the power it uses comes from renewable sources. This reduces its carbon footprint.

Bundled vs. unbundled RECs

There are two primary types of RECs on the market:

Bundled

Bundled RECs are typically the standard type. This means the certificate you purchase comes with renewable energy for your corporation to use. These are common with new projects, especially new production company facilities. Companies might purchase these so developers may receive additional financing and can show they actively invest in creating more renewable energy options for a community.

Unbundled

Unbundled RECs are typically the cheaper option available for corporations to buy. As they’re different from bundled RECs, they don’t directly contribute to the creation of new renewable sources that can provide green energy in the future. This means companies still use or provide renewable resources that can count towards the required standards.

FAQ about RECs

Here are the answers to several other frequently asked questions about RECs:

How do RECs differ from carbon offsets?

Carbon offsets and RECs are similar concepts, as their primary goals are to reduce carbon emissions and build a more sustainable future. People often call carbon offsets other terms, such as voluntary emission reductions or carbon reduction tons. Rather than reducing the company’s overall electricity use, carbon offsets focus on specific projects that may improve the condition of the environment, including reducing emissions or sequestering. These often need government agencies’ approval to show that the impact of the changes is permanent and effective.

Another key difference between the two is how you measure carbon offsets. Rather than megawatts per hour, the measurement of carbon offsets depends on the metric ton of carbon they reduce.

What is REC arbitrage?

REC arbitrage is a process where energy consumers purchase and sell RECs with several goals. As the prices can fluctuate between locations, this process may help you find the best value when purchasing these certificates and limit the amount you spend on renewable energy. This also helps you develop more carbon reduction claims and increase your carbon reduction rate. People or companies financing new renewable energy projects or those who purchase renewable energy through these projects often use arbitrage.

Who issues RECs?

On 26 October 2021, the Energy Market Authority launched the “Singapore Standard (SS) 673: Code of Practice for Renewable Energy Certificates (RECs)” to ensure that all registries, including those privately-run, issue RECs in accordance with the same set of criteria and procedures. The number of RECs issued depends on each situation and location. For example, energy departments requiring a certain percentage of carbon emissions reduction can issue the necessary number of certificates a company requires to meet the goal.

Who benefits from RECs?

The following are the entities that benefit from RECs:

- Participating companies: Companies committed to reducing their carbon emissions benefit, as they meet the requirements set by the National Environment Agency and can avoid carbon taxes.

- Energy companies: Energy companies providing alternative solutions can perform better and build more relationships with companies and individuals.

- The public: As the primary goal of RECs is to create a more sustainable future through more efficient energy solutions, public health can improve in some areas and create a better environment.

What are the attributes of RECs?

Depending on who issues the REC, the certificate data attributes can vary for each.

Here are some of the common attributes of RECs:

- certificate type

- renewable energy type

- renewable facility location

- project capacity

- project completion date

- utility used

- emissions rate

What is the market like for RECs?

In the global REC market, power companies work across locations in this active market. This means their location may have higher standards, so more companies need more certificates in that location, resulting in an increased price. In locations with lower standards, they might purchase more certificates at a lower price. Because this market can remain competitive, it ensures that companies focus on improving sustainability as a part of their business plans.

What factors affect the price of an REC?

There are several factors that can influence the price of RECs:

- Demand: As with many purchases, the higher demand for RECs can increase the price. This is common in locations with higher energy standards.

- Market factors: Market factors, such as changing laws or inflation can affect the price of RECs, as volatility can affect how possible sustainability goals are for companies.

- Compliance: While many RECs require purchasing in certain locations, some are voluntary, which can affect the price. Voluntary market RECs often have lower prices and might be more common.

- Project type: Project type can also affect the price of RECs, as more impactful projects might create more expensive certificates, depending on the amount of energy they save.

Please note that none of the companies, institutions or organizations mentioned in this article are affiliated with Indeed.

This article is based on information available at the time of writing, which may change at any time. Indeed does not guarantee that this information is always up-to-date. Please seek out local resources for the latest on this topic.